The Environmental Impact of Cryptocurrency: A Rising Concern

With the meteoric rise in the interest and investment in cryptocurrency, much attention has been placed on the industry's environmental footprint. Cryptocurrencies, while innovative and potentially transformative to the world of finance, come with significant and often overlooked environmental costs. This article delves into the environmental implications of cryptocurrency mining, with a special focus on Bitcoin. It also explores the technical aspects behind this process and potential mitigating solutions.

Understanding Cryptocurrency Mining

In its simplest form, cryptocurrency mining involves solving complex equations to validate transactions and record them on a public ledger known as the blockchain. This crusher-style computation process is resource-intensive, demanding substantial computational power and thus significant amounts of energy. The most widely known cryptocurrency, Bitcoin, employs a confirmation algorithm called Proof of Work (PoW) which is particularly energy-consuming.

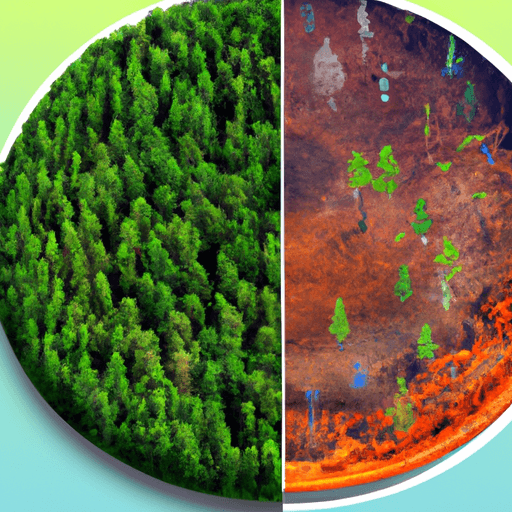

Cryptocurrency Mining and the Environment

The environmental concern surrounding cryptocurrency mining stems largely from its substantial energy consumption. To give perspective, Bitcoin's annual energy usage surpasses that of some countries. Furthermore, much of this energy is sourced from fossil fuels, contributing to carbon emissions and exacerbating climate change. The spatial decentralization of cryptocurrency mining means operations are often established where electricity is cheapest, which unfortunately is often regions with predominantly coal-powered energy.

Potential Solutions

There are certainly viable solutions that can be pursued to mitigate the environmental impacts of cryptocurrency mining. They can be classified into three categories: industry-led, government-led, and individual efforts.

Industry-led

One major solution is transitioning from energy-hungry PoW protocols to more sustainable alternatives like proof of stake (PoS). Ethereum, the second-largest cryptocurrency, is undergoing such a transformation. Furthermore, mining firms could migrate to areas where renewable energy is abundant and cheap, minimizing their carbon footprint.

Government-led

Government interventions might include implementing stricter regulations on energy use in the mining process, or providing incentives for miners to use more sustainable energy sources. Environmental taxation could also dissuade excessive energy consumption.

Individual efforts

Individuals, who form a substantial part of the cryptocurrency market, can leverage their influence. By prioritizing the use and investment in eco-friendly cryptocurrencies, they can indirectly pressure industry players to adopt greener operations.

In Conclusion

While cryptocurrencies present a multitude of benefits, from decentralization to potential financial inclusivity, it is critical to acknowledge their environmental costs. Striking a balance between leveraging the benefits of cryptocurrencies and managing their environmental impact remains an ongoing challenge.

Comments

Leave a Comment